tax act online stimulus check

You may soon receive a 1200 or 2400 stimulus check from the government if you set up your tax refund with direct deposit though it will be a longer wait if you need a paper check. Calculations are estimates based on the figures from the Consolidated Appropriations Act as.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Line 17 on Form 540.

. 1 online tax filing solution for self-employed. This tool will provide an estimated payment amount based on the information you provide. The American Rescue Plan Act ARP Act.

If youve filed tax returns for 2019 or 2020 or if you signed up to receive a stimulus check from the Internal Revenue Service you will get this tax relief automatically. With the agencys delay in processing tax returns trying to register for a new direct deposit account with your 2020 tax return wont get you into the system quickly enough. Check if you qualify for the Golden State Stimulus II.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Qualifying children and whether to send payments by check or direct deposit. 2021 Third Stimulus Check Income Qualification and Phase-out Thresholds Limits Expanding Dependent Eligibility.

President Biden signed the American Rescue Plan Act on March 11 2021. If you hadnt filed your 2019 taxes your 2018 tax return information was used. This includes deceased and incarcerated.

If your AGI is above 75000 as a single filer the stimulus relief starts phasing out. Had wages of 0 to 75000 for the 2020 tax year. Americas 1 tax preparation provider.

Use our 600 second stimulus check calculator to see how much you and your family might receive. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The relief phases out completely once AGI exceeds 99000.

Third Dependent Stimulus Payment. Line 16 on Form 540 2EZ. COVID-19 Tax Relief for Student Loan Borrowers.

What does the third stimulus check mean for US. Single Filers and Married Filing Separately. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

The latest round of stimulus checks will allow people to use the later of their 2019 or 2020 tax data file your tax return via TurboTax to ensure the latest dependent and payment information can be usedFurther the new legislation has expanded the. Your eligibility for such payment and actual results may vary based on information you provide on your tax return. You can see all the eligibility rules.

Provisions in the bill authorized a third round of stimulus checks worth 1400 for each eligible person 2800 for couples. Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page. The latest amount in this round of payments is 1400 for each dependent the same as the adult stimulus payment.

Delivery Timelines for Stimulus Payments. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. However people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Child Support Debt and Your Stimulus Payments. The third stimulus check is part of the 2021 American Rescue Plan Act ARPA a Coronavirus government relief package designed to provide further economic assistance to Americans struggling with the economic impacts of COVID-19The relief package includes direct 1400 payments to each. Self-Employed defined as a return with a Schedule CC-EZ tax form.

To qualify you must have. Americas 1 tax preparation provider. This article was originally published on March 31 2020.

A third round of dependent stimulus check payments has now been paid under the enacted 19 Trillion Biden COVID Relief Package American Rescue Plan Act ARPA. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. For more specific scenarios that could impact your eligibility visit Golden State Stimulus Help.

In mid-March 2021 millions of Americans received a third stimulus payment via direct deposit with additional rounds of payments following in the weeks after by direct deposit and through the mail as a check or debit card. Had a California Adjusted Gross Income CA AGI of 1 to 75000 for the 2020 tax year. Your stimulus amount starts phasing out when your income goes over 112500 and the stimulus amount hits 0 when AGI exceeds 136500.

People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021. Securely access your IRS online account to view the total of your first second and third Economic Impact Payment amounts under the Tax Records page. Filed your 2020 taxes by October 15 2021.

1 online tax filing solution for self-employed. You do not need to. For this information refer to.

Single adults with a Social Security number and adjusted gross income of 75000 or less are eligible.

2020 Stimulus Check Amounts And Income Thresholds Visual Ly Income Filing Taxes Thresholds

Stimulus Registration Economic Impact Payments Taxact

Third Stimulus Check Ninth Batch Of 1 400 Checks Is In The Mail Fortune

Many Americans Will Receive 1 200 Payments From The Irs And Many Have Questions About The Motley Fool Debt Money

Stimulus Checks Tax Returns 2021

Third Stimulus Check When Could You Get A 1 400 Check In 2021 Irs Money Sign Prepaid Debit Cards

Didn T Get A 2nd Stimulus Check Here S How To Free File With The Irs Silive Com

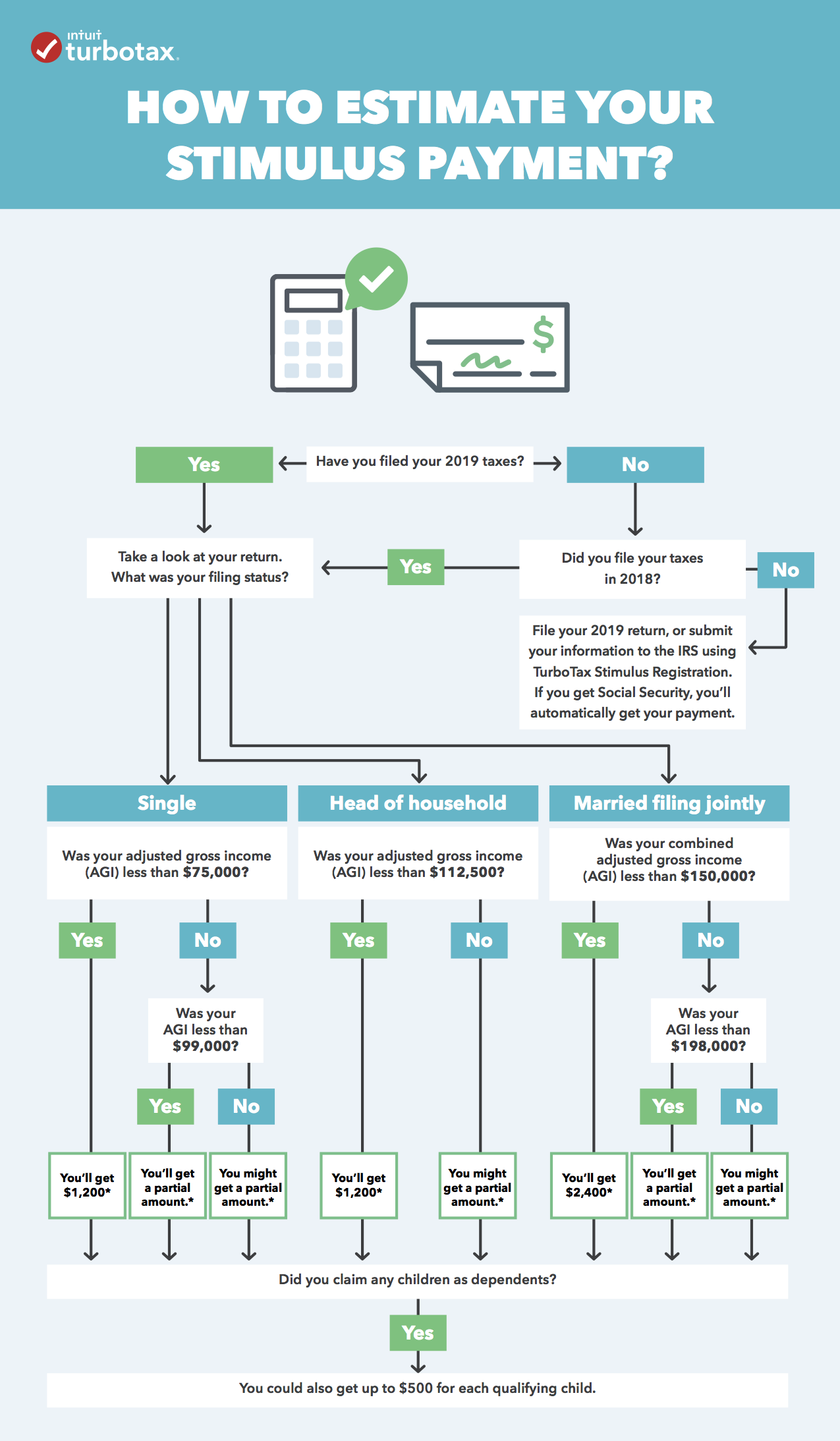

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

How To Claim A Missing Stimulus Check

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Your 2020 Stimulus Check How Much When And Other Questions Answered

How To Get A Stimulus Check If You Don T File Taxes Updated For 2021

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

2nd Stimulus Check How To Track Your Money Through Irs Get My Payment Site Syracuse Com

Third Stimulus Check Will It Be Based On 2019 Or 2020 Taxes Kare11 Com

Still Didn T Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Don T Owe Taxes

Look For Line 30 On Your 1040 To Claim Your Stimulus Payment The Washington Post